How Does Leverage Explain the Difference Between Roa and Roe

This means that in this scenario ROE and ROA will be equal. ROA tends to tell us how effectively an organization is taking earnings advantage of its base of assets.

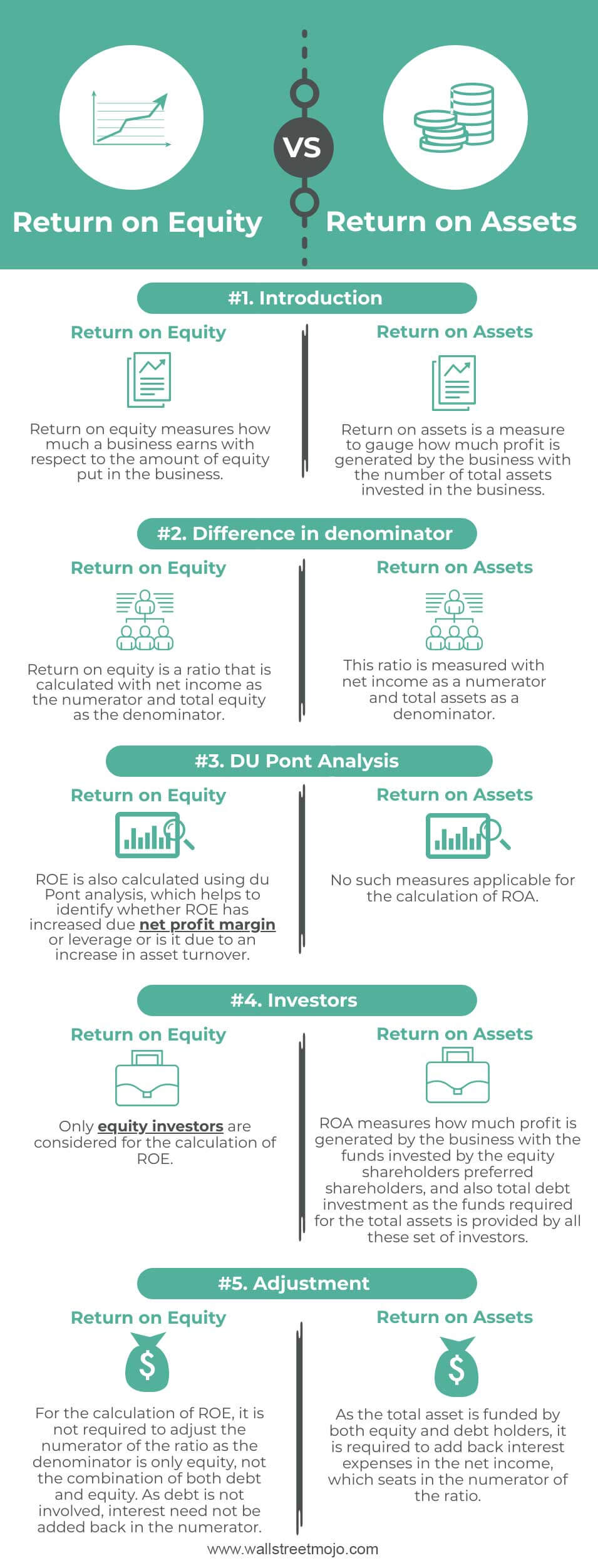

Roe Vs Roa Top 7 Differences To Learn With Infographics

Basically the profit divided by equity.

. 5 Explain the trade-off between net operating profit margin and. It is calculated by using the formula Net IncomeAverage equity. In most cases the bulk of the difference between return on assets and return on equity is debt.

RoERoA RoA-iDebtEquity A bit of explanation to this mumbo jumbo. Return on Equity is the one were after. There you have it.

Heres how to calculate the return on assets ROA ratio. 2The formula for ROE is net income after taxes divided by shareholder equity while the formula for RNOA is net income divided by total assets. The DuPont analysis comes from DuPont Corporations which began using this method in the 1920s to break down the components of ROE.

Operating Leverage Effect. However financial leverage really increases the variability of a companys net income and its return on equity. EBIT Net operating assets ROA.

But what do they mean. The way that a companys debt is taken into account is the main difference between ROE and ROA. A higher ROE is not always an indicator of an impressive.

The calculations are pretty easy. Heres a quick write-up how I see it work. Higher the leverage narrower the gap between ROE and ROCE finally if the company is highly leveraged ROE will be higher than ROCE due to smaller contribution of equity capital in companys capital structure.

This means that the net income and return on. ROE measures the efficiency of capital or financial management. The moment there is some leverage in the balance sheet the gap between ROCE and ROE is narrowed as ROE is enhanced from 105 to 114.

With explicit leveraging equations that explain when leverage from each type of liability is favorable or unfavorable. In the absence of debt shareholder equity and the companys total assets will be equal. Is greater FLEV always better.

The major factor that separates ROE and ROA is financial leverage ie. Now if the company decides to take a loan ROE would become greater than ROA. Debt is included in ROA which can be clearly seen in the balance sheetTotal Assets Liabilities Shareholders Equity 3.

The big factor that separates ROE and ROA is financial leverage or debt. It is one of the best measure of performance of an entity from the shareholder perspectiveSo it. Ever wondered what was behind that dreaded term financial leverage.

A company that borrows a lot of money is going to have a significant gap between its total assets and its total equity and that will translate into a big difference in the. Logically their ROE and ROA would also be the same. This is what an investor stock holder or a manager wants to maximise.

100 1 rating Return on Equity is the return earned by company on its average equity. 1ROE is Return on Equity while RNOA is Return on Net Operating Asset. ROA Return On Assets calculates how much income is generated as a proportion of assets while ROI Return On Investment measures the income generation as opposed to investment.

So return on assets is distinguished from return on equity with the difference attributed to leverage. How does financial leverage explains the difference between ROA and ROE. 3 What is the difference between the traditional ROA measure part of the traditional DuPont analysis and the return on net operating assets RNOA.

A high degree of financial leverage implies that a company has high levels of interest payments which could negatively impact its net income bottom-line earnings per share as well as return on equity ROE. By taking on debt a company increases its assets thanks to the cash that comes in. By splitting ROE return on equity into three parts companies can more easily understand changes in their ROE over.

Return on Equity ROE is generally net income divided by equity while Return on Assets ROA is net income divided by average assets. ROA and ROI are two vital measures that can be used in this exercise. In the DuPont equation ROE is equal to profit margin multiplied by asset turnover multiplied by financial leverage.

The balance sheets fundamental equation shows how this is. 4 Explain how return on net operating assets RNOA and financial leverage FLEV affect Return on Equity ROE. This is the key difference between ROA and ROI.

However in the. EPS and ROE in new with debt Structure Recession Expected Expansion EBIT 1000 2000 3000 Interest 640 640 640 Net income 360 1360 2360 EPS 150 567 983 ROA 18 68 118 ROE 30 113 197 Proposed Shares Outstanding 240 shares The variability in both ROE and EPS increases when financial leverage is increased. But if that company takes on financial leverage its ROE would rise above its ROA.

The way that a companys debt is taken into account is the main difference between ROE and ROA. If there is no debt shareholders equity and total assets of the company will be same. A good part of a businesss net income for the year could be due to financial leverage.

If we talk the leverage effect on ROE it means we talking operating leverage effect financial leverage effect and combined leverage effect on ROE. But if that company takes on financial leverage its ROE would be higher than its ROA. This equation uses net operating assets which equals total assets less the non-interest-bearing operating liabilities of the business.

Under DuPont analysis return on equity is equal to the profit margin multiplied by asset turnover multiplied by financial leverage. One major difference between ROE and ROA is debt. Overview and Key Difference.

DuPont analysis is an equation that shows that a companys Return on Equity and Return on Assets can be broken down into its components and can be represented as a product of multiple figures. Change of EBIT is more than Change in Sale If change of earning before interest and tax is more than change in sale this operating leverage will effect ROE positively because at this level per unit.

Relationship Between Roa And Roe Download Scientific Diagram

Roe Vs Roa Top 5 Differences With Infographics

Return On Assets Roa And Return On Equity Roe Fundamental Analysis Youtube

Comments

Post a Comment